You Need A Budget

I've tried every possible budgeting software and practice in existence - with little to no success. I've used cash envelopes, Mint.com, Quicken, pencil-and-paper, and even the ineffective take-a-quick-look-at-my-checking-account-balance-to-see-if-i-can-afford-this-item method. To make matters worse, I had my money spread across multiple accounts - emergency fund, car savings, checking, etc. making everything that much more confusing. I was getting to the point where I thought budgeting just wasn't for me, I couldn't seem to wrap my head around it.

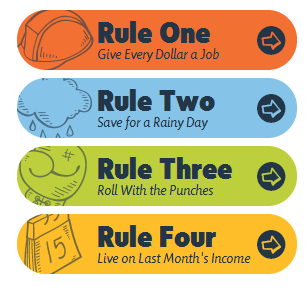

Then, one day I met You Need a Budget - or, YNAB. YNAB is a hyper-usable piece of budgeting software that is built around four easy rules. If you only take one thing away from this post, make sure it's Rule #4.

- Give Every Dollar a Job - When you look at your checking account, what is that $1,744.32 balance really telling you? Can you go buy that rad flat screen you saw at Costco this morning, or do you need those dollars to fund your rent for next month? Who knows?! If you're like me, this is where impulse wins over clear thinking, which means I end up coming home with the flat screen and a new PS4.

- Save for a Rainy Day - Plan for the larger, less frequent expenses so you aren't caught off guard. This year, I owed my HOA dues, car insurance premiums, taxes, and a couple of additional largeish expenses all in the first four months. Having some cushion in my budget helped me get through it. Bruised, but not broken.

- Roll with the Punches - My least favorite thing about any budget (except YNAB) is the strict restriction placed on my spending. If I only allocated $150 for eating out, and I get invited to one-to-many get-togethers, I ended up feeling like a chump when I exceeded my budget. That's no way to live life! With YNAB, you can make intentional decisions to overspend in one category so long as you re-allocate other budgeted money to make up the difference.

- Live on Last Month's Income - The money you earn this month should go towards next month's expenses. This way, you automatically start each month with all of the dollars you already need. Now, instead of watching your checking account get dangerously close to $0 each month, you have some built in buffer to finish strong.

YNAB has helped me get a better handle on my monthly finances - which has been a great help since our daughter was born. I know exactly where every dollar I spend is going. I can easily check how much I have left in a given budget category, and I can move things around during the more hectic months.

Interested in checking out YNAB? You can get a free 34 day trial and 10% off with this link.

Happy budgeting.

Subscribe for Free

Want to stay ahead of the curve? Subscribe now to receive the latest updates, actionable insights, and thought-provoking ideas around business, technology, and leadership straight to your inbox.